The Bitcoin Bottom.

Gm traders,

Over the past two weeks:

The Federal Reserve held rates steady at 4.25%–4.5%.

A war broke out between Israel and Iran.

The United States officially entered the conflict.

And yet… Bitcoin is trading at $101,380.

Let that sink in.

Despite heightened geopolitical tensions and interest rate uncertainty, the market continues to do what it always does: move on its own terms.

If you’ve been following along — especially in Don’t Fall for the Ethereum Trap — none of this should come as a surprise.

That final flush lower? It happened.

Limit fills? Triggered.

Now we look ahead.

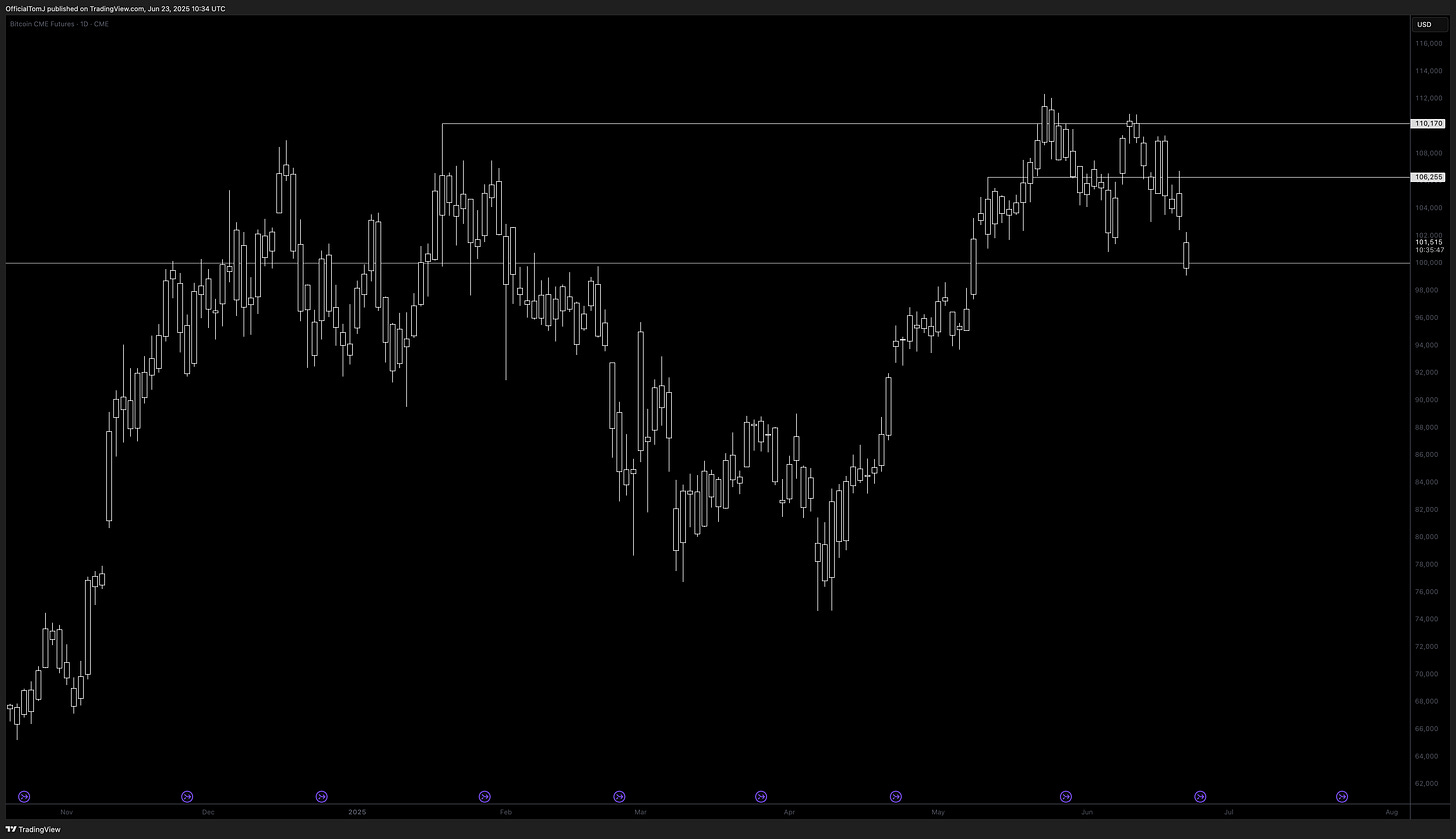

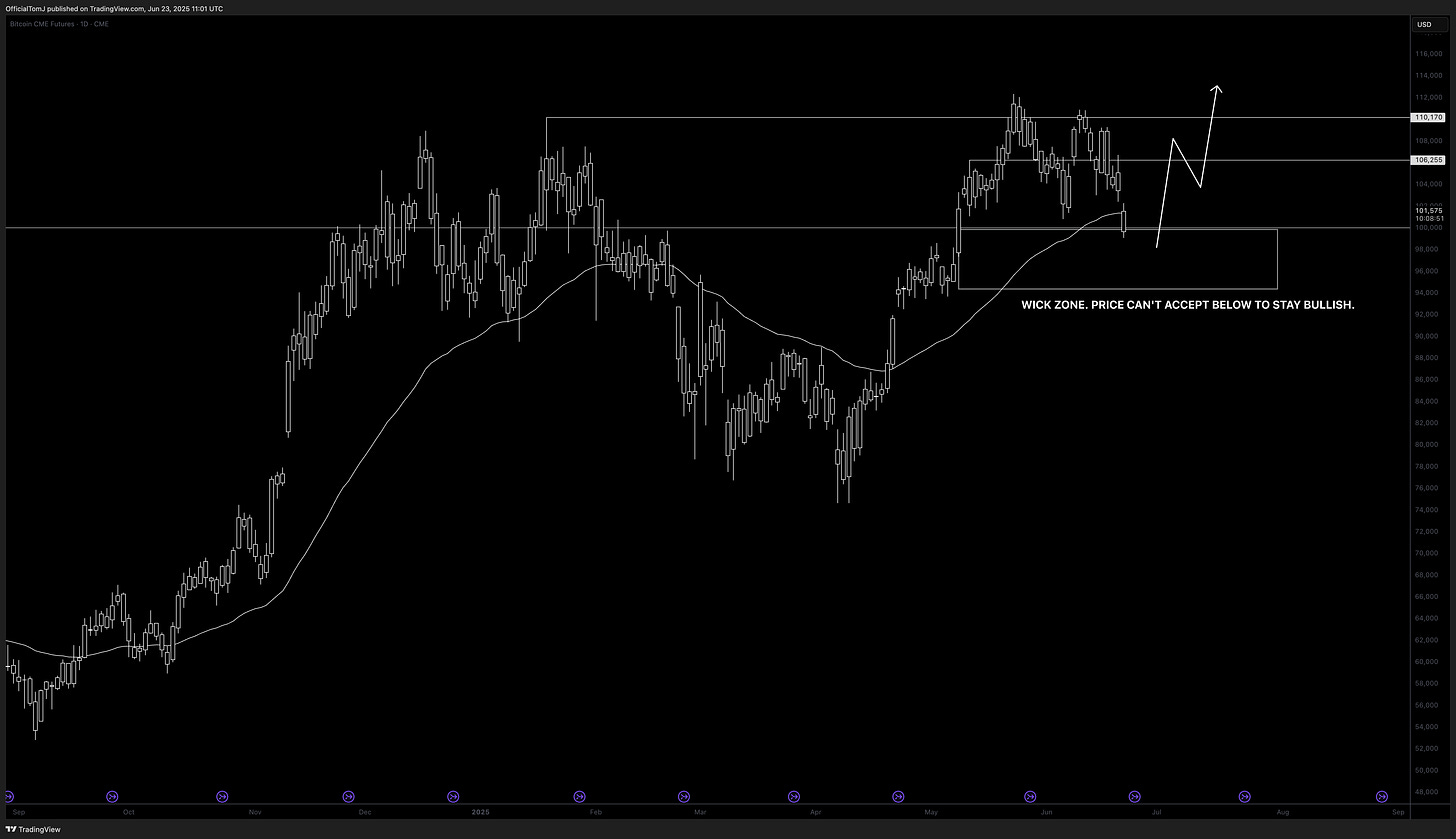

Bitcoin flushed the $100,000 low.

As expected, this move lower aligned with a spike in global uncertainty — particularly as the U.S. responded with targeted strikes on Iranian nuclear infrastructure, escalating the Israel–Iran conflict.

I’m not a geopolitical analyst. I don’t pretend to be.

But I do believe that price action often tells the story before the headlines do.

And while my thoughts are with those impacted by these events, we have to remain focused on structure, not speculation.

This correction completes what began back on May 22nd, when Bitcoin printed new all-time highs.

$TOTAL: Max Fear, and Max Opportunity.

The correction in Bitcoin was mirrored across the board.

$TOTAL is now testing the bottom of its macro channel, sitting just above the $3T support region — an area that marked panic lows during the Trump tariff saga.

Altcoins, as expected, got hit harder.

BTC dominance is up +3.45%, while some of the weakest alts have retraced to fear-driven levels we haven’t seen in months.

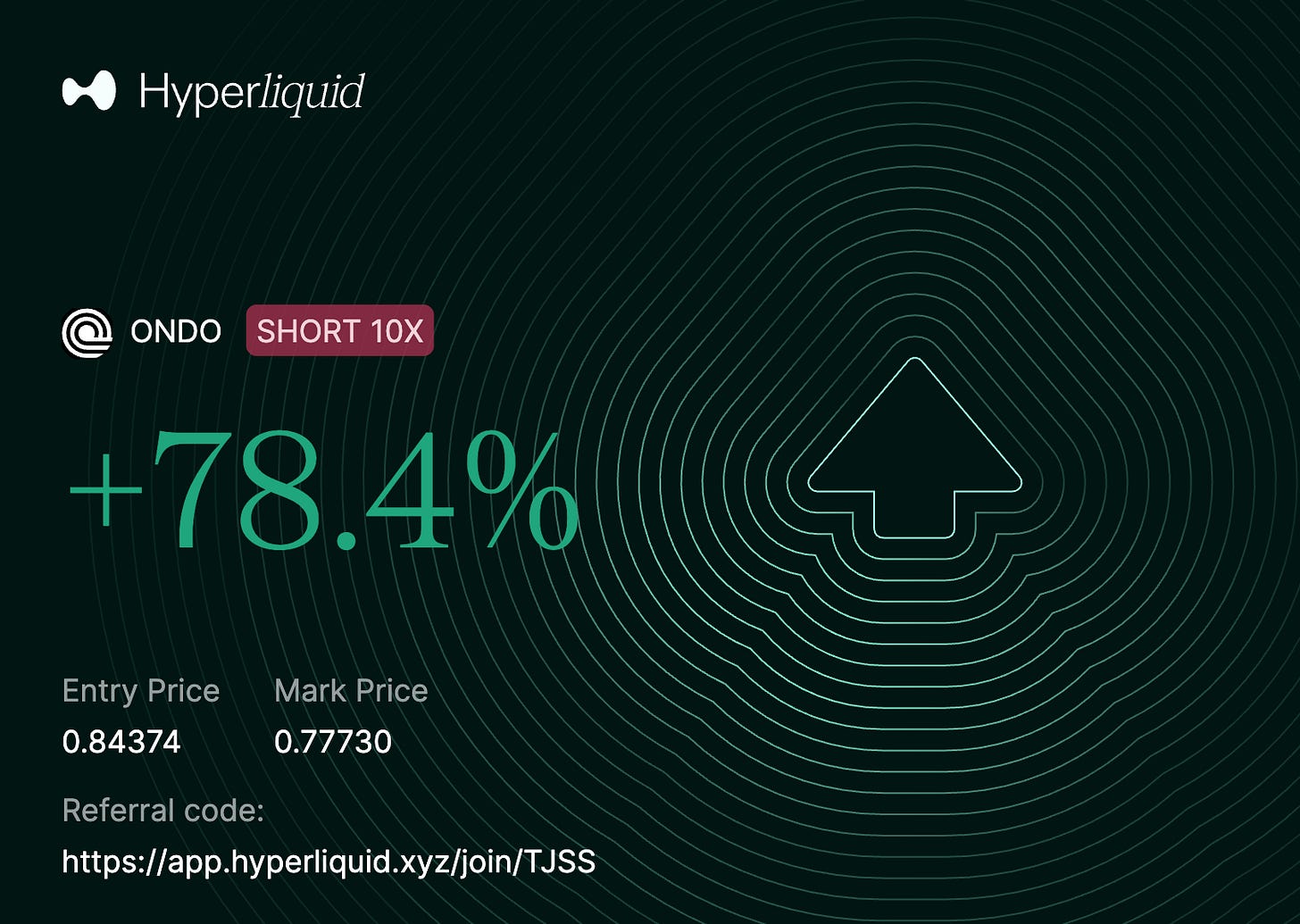

We didn’t sit on our hands.

Took profits on our ONDO/USD short

Unwound hedges on HYPE/USD and re-entered at the Daily 50EMA retest

That hedge alone increased our $HYPE exposure by +20%. A calculated play to sidestep short-term volatility.

The Next Portfolio Moves.

Now that we’ve entered the “final correction territory,” we’re hunting for long setups.

The structure is simple:

BTC must hold the Daily 50EMA on CME

$TOTAL must defend the channel lows

A deeper spike is possible — even likely — but as long as higher time frame structure holds, the bullish thesis remains intact.

From there, we’ll aim for a recovery toward the top of the channel… and reassess as new highs come into play.

Current positions are as follows:

(PERP) LONG 2x BTC (from the Tariff lows). May add further once $100,000 confirms support.

(SPOT) LONG HYPE: $32.898 (exit if the D50 breaks and has a retest).

(PERP) LONG XRP: $2.0402 (a little early but it's a swing position with an okay LTF entry. Expectation is a HL to form before a spike into the $2.90 zone https://www.tradingview.com/x/d9jlVwmr/).

(SPOT) NEW LONG FARTCOIN: $0.92966 (this is a new position to trade the FARTCOIN trend with a big target of $2.87)

More on this FARTCOIN/USD position later.

Focus on the charts. Follow the structure.

And as always — trade with intention, not emotion.

Best,

Thomas Johnston.

Founder, Chronicles.